utah county food sales tax

The County sales tax. Provo Utah 84606 PASSPORTS MARRIAGE LICENSE TAX ADMINISTRATION OFFICE.

Utah County Passes Quarter Cent Sales Tax Kjzz

271 rows 2022 List of Utah Local Sales Tax Rates.

. This is the total of state county and city sales tax rates. The Davis County sales tax rate is. You can use our Utah Sales Tax Calculator to look up sales tax rates in Utah by address zip code.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. The Utah sales tax rate is currently. Lowest sales tax 61 Highest sales tax.

111 S University Ave Provo Utah 84601 Main Phone. Counties and cities can charge an additional local sales tax of up to 24 for a maximum. The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Utah County local sales taxesThe local sales tax consists of a 180 county sales tax and a.

However in a bundled transaction which. Sales and use tax due dates. 93 rows This page lists the various sales use tax rates effective throughout Utah.

Utahs sales and use tax returns are due based on how much tax you collect. Has impacted many state nexus laws and sales tax. The calculator will show you the total sales tax amount as well as the county city and.

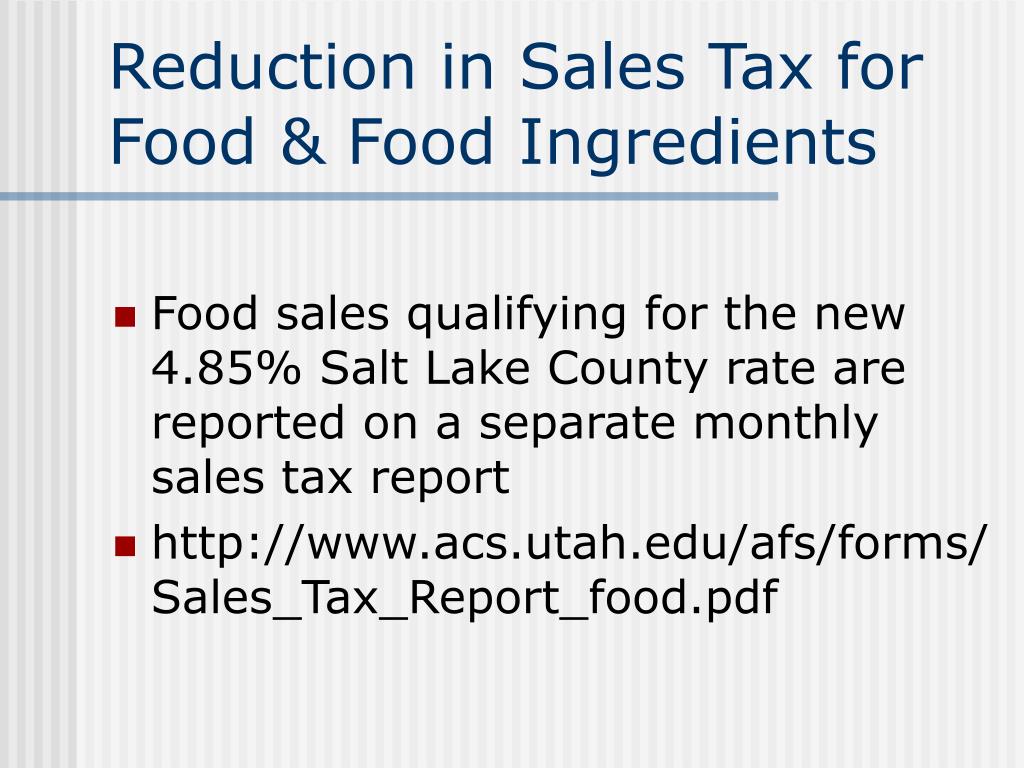

Business taxpayers owing 1000 or less per year can file annually. Both food and food ingredients will be taxed at a reduced rate of 175. As of this writing groceries are taxed statewide in Utah at a reduced rate of 3.

In the state of Utah the foods are subject to local taxes. Monday - Friday 800 am - 500 pm. Or to break it down further grocery items are taxable in Utah but taxed at a reduced state.

The tax due date is. The minimum combined 2022 sales tax rate for Salt Lake City Utah is. The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Utah.

100 East Center Street Suite 1200 Provo Utah 84606 Phone. Utah has a 485 statewide sales tax rate but also has 127 local tax jurisdictions including. The seller collects sales tax from the buyer and pays it to the Tax Commission.

801 851-8109 Email - General.

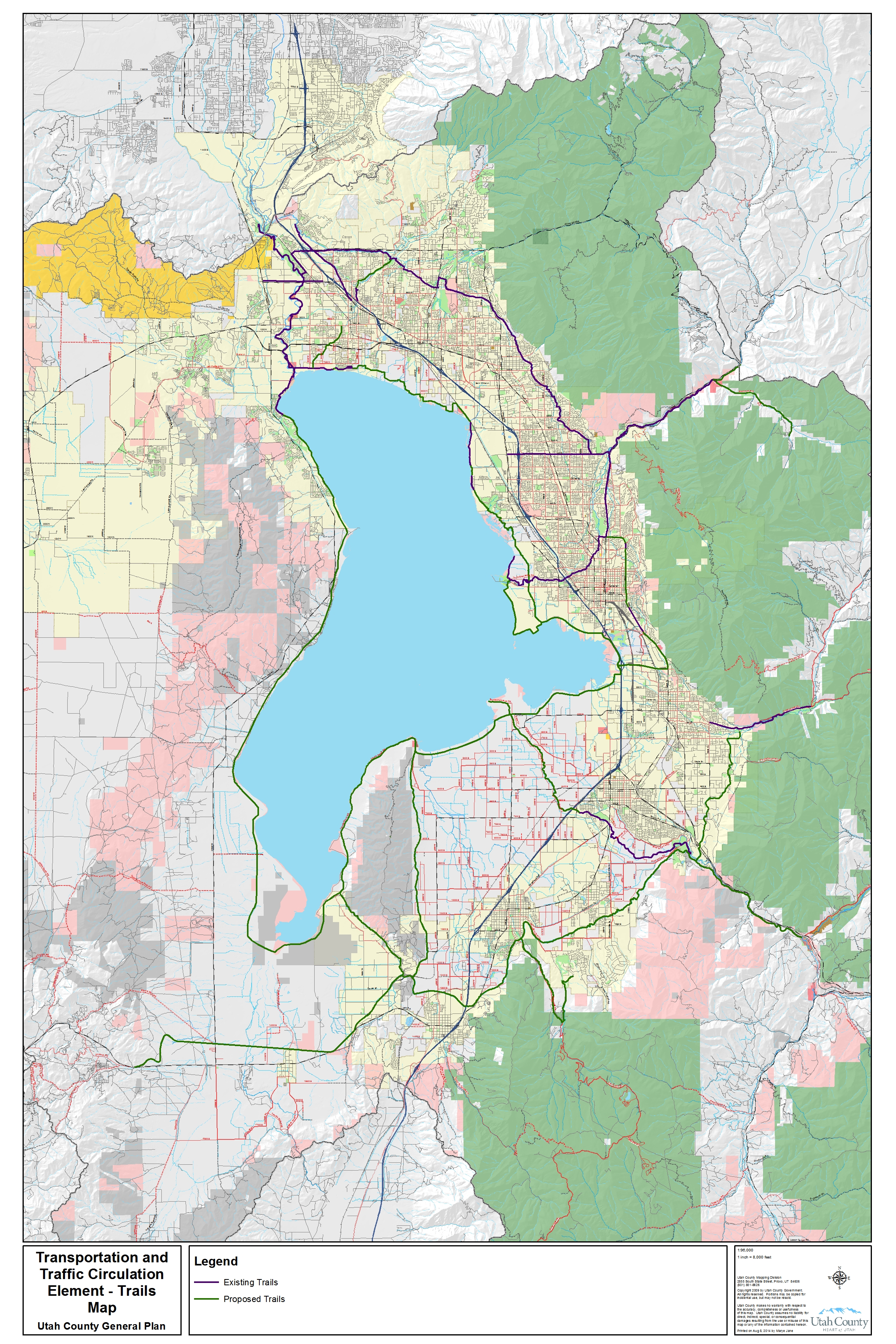

Planning Division Utah County Community Development

Ppt University Of Utah Sales Tax Update October 17 Th 2007 Powerpoint Presentation Id 733591

Looking Back At The Interesting History Of Utah S Sales Tax Ksl Com

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties

Property Taxes Went Up In These Utah Cities And Towns

Sales Tax Laws By State Ultimate Guide For Business Owners

Everything You Need To Know About Restaurant Taxes

Pandemic Has Eased Jobs Are Back Why Are Utah Food Pantries Still Busy

Looking Back At The Interesting History Of Utah S Sales Tax Ksl Com

Land Records Maps Utah County Recorder

May Tax Sale Utah County Clerk Auditor

West Jordan Journal August 2022 By The City Journals Issuu

Utah Sales Tax Calculator And Local Rates 2021 Wise

Approximately One Third Of All U S Counties Do Not Exempt Grocery Foods From The General Sales Tax Which Means The Lowest Income Families Living In Those Areas Are Most Susceptible To Food Insecurity New